Financial Forms

PRE-AUTHORIZED DEBIT - FORM.pdf62.49 KB

PRE-AUTHORIZED DEBIT - FORM.pdf62.49 KB Change of address (Assessment Tax Roll)155.42 KB

Change of address (Assessment Tax Roll)155.42 KB Rebates for Vacant Commercial and Industrial Units will End December 31, 201991.00 KB

Rebates for Vacant Commercial and Industrial Units will End December 31, 201991.00 KB

Tax Rebate Program

Several property tax rebate programs are offered to charities, as well as to low-income seniors and low-income persons with disabilities.

Please visit the United Counties of Prescott and Russell Website which contains the documentation and application forms necessary to submit an application to the Town at:

Water, Sewage Services and Garbage Collection Rates

Fees charged for these services are not considered taxes but rather user fees. These services are self-financed, meaning that all costs of operations are covered by user fees. For water and sewer, rates are established on a fixed and consumption cost formula that represents the infrastructure and operating costs.

New starting April 2024

On January 29, 2024, the Municipal Council voted in favor of a change regarding the fixed rates for drinking water and wastewater treatment to allow for a more fair distribution of costs, based on usage and impact on underground infrastructure.

Why?

The universal fixed rate applied to each property did not reflect the actual cost of each of the different categories of users on the infrastructure. Factors such as pipe size, meter size, water demand, and fire protection were not considered, making the model unfair and inequitable for all users in the Town of Hawkesbury.

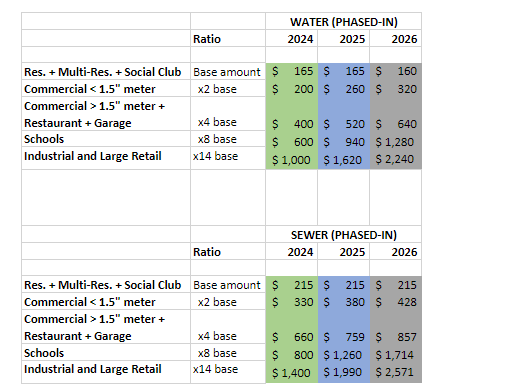

The rates, which were initially evenly distributed between residential and commercial categories, will be adjusted to reflect these differences more fairly. This adjustment largely benefits the residential category, with over 5,300 units saving on their fixed rates. For commercial and industrial fixed rates, the calculation was established based on a multiplying factor as follows:

| Property Type | Multiplying factor |

| Residential, Multi-residential, and institutional properties | 1 |

| Commercial properties with a water meter less than 1.5" in circumference | 2 |

|

Commercial properties with a water meter 1.5" or larger in circumference, Restaurants, Dealerships or Repair services store |

4 |

| Schools | 8 |

| Industrial and Large-Scale Business Enterprises (10,000 Square Feet and above) | 14 |

What's the Impact?

According to the old billing model (combined drinking water and wastewater), the annual fixed rate would have been $405.00 in 2024. With this new adjustment, the residential annual fixed rate will be $380.00 for 2024, resulting in savings of $25.00. In total, over the next 5 years, residential properties will save approximately $230.00 on fixed drinking water and sanitary sewers rates according to the new model.

Other property categories will see increases in their fixed rates. However, the Town has decided to gradually phase-in the increase of this new model over 3 years. This will allow other property categories to adjust to this new reality, where the actual full increase will only take effect in 2026.

Increase model for a phased-in method based on property type

Dates to remember:

Billing is done quarterly in January, April, July and October

Year 2024

![]() N_13-2024_fixing_the_rates_for_the_water_and_sewer_services.pdf

N_13-2024_fixing_the_rates_for_the_water_and_sewer_services.pdf

![]() N_14-2024_to_impose_a_rate_for_the_collection_disposal_and_diversion_waste.pdf

N_14-2024_to_impose_a_rate_for_the_collection_disposal_and_diversion_waste.pdf

Budgets, Tax Rates and Reports

Financial reports allow the citizens to follow the financial performances of the Town. The budget is a great tool to understand the allocation of the property taxes through each municipal services. The audited Financial Statements can be used to evaluate the financial results of the past year and also provide an overview of the financial position of the Town.

| Year | Documents |

|---|---|

| 2022 |

Operating and Capital Budgets |

| 2021 |

Operating and Capital Budgets

Presentation to Council - Budget 2021 |

| 2020 | |

| 2019 |

|

| 2018 |

| Year | Documents |

|---|---|

| 2023 | |

| 2022 | |

| 2021 | |

| 2020 | |

| 2019 | |

| 2018 | |

| 2017 | |

| 2016 | |

| 2015 | |

| 2014 |

| Year | Documents |

|---|---|

| 2020 | |

| 2024 | |

| 2022 |

Ontario Supports Modernization of Small and Rural Municipalities

Project Title

Town of Hawkesbury Telecommunication Infrastructure Review

Objectives

The objective of the Project is to review the Recipient’s telecommunications system with the goal of recommending cost savings and service improvements.

Description

The Recipient will retain an independent third-party reviewer to conduct a review that assesses both the deficiencies in the Recipient’s existing telecommunications system, along with requirements for future system expansion. As part of the review, the reviewer will provide recommendations for cost savings and service improvements. Next, the reviewer will provide the Recipient with recommendations for preparing a request for proposal (RFP) for its telecommunications system expansion.

Finance Department

Please note that since December 1, 2021, the Finance Department is closed between 12 p.m. and 1 p.m. (like the rest of the Town Hall).

The Finance Department is primarily responsible for managing all the financial transactions and accounting issues for all municipal departments and ensures that all financial resources and assets are coordinated and conducted cost-effectively for its efficient operation.

The Treasurer and his team oversees all of the municipality’s financial matters. Following decisions and policies set by Council, our responsibilities is to prepare and monitor the annual budget; to prepare and record accounting information; to review the procurements; to administer tax collection, water, sewer and garbage billings; to manage the municipal debt, the banking arrangements as well as long and short term investments; and loans.

How to avoid late payment charges?

Canada Post has a policy that mail will not be delivered unless it has the correct postal address. Therefore, please notify us of any changes, including your postal box number, for your property taxes and/or water/sewer/garbage account.

If you have not received your property tax bills or your quarterly user fee billings for the current year, please contact us at 613-632-0106.

Property taxes

Please note that since December 1, 2021, the Finance Department is closed between 12 p.m. and 1 p.m. (like the rest of the Town Hall).

Property taxes:

There are two tax bills per year, for a total of 4 installments:

- the Interim Billing is payable in two installments; at the end of March and end of June;

- the Final Billing is payable in two installments; at the end of September and end of November.

Methods of payments available are:

Payments can be made as follow:

- Municipal Office, Door 3 (previously Door B as indicated on your documents) at 600 Higginson Street. After hours, you may deposit your envelope in our dropbox.

- Internet 1

- in the category Tax, select Hawkesbury Taxes and enter the15 digits of your roll number;

- At your financial institution 1

- Paymentus (Secure online payment)

- Pay your bill in 3 easy steps without registering. All you need is your account number from your paper bill.

Payments made prior to midnight will be posted to your account next day. Payments made after midnight will be posted within 48 hours. For each payment, you will receive a confirmation number for your records. - Please follow this link: https://ipn.paymentus.com/cp/hawk?lang=en

- Pay your bill in 3 easy steps without registering. All you need is your account number from your paper bill.

Pre-authorized debit plan:

-

A pre-authorized payment method is also available. If you are interested, simply fill out the following form

PRE-AUTHORIZED_DEBIT_-_FORM.pdf62.49 KB, include a copy of a void cheque and return it to the Town of Hawkesbury at . If you have any questions or for further details, please contact the municipality at (613) 632-0106.

PRE-AUTHORIZED_DEBIT_-_FORM.pdf62.49 KB, include a copy of a void cheque and return it to the Town of Hawkesbury at . If you have any questions or for further details, please contact the municipality at (613) 632-0106.

Postdated cheque:

- Please make your payment to the order of the Corporation of the Town of Hawkesbury

1 Note: When choosing to make a payment through the internet or directly at your financial institution, please ensure that the municipality receives your payment before or by the due date to avoid late penalty fees. We recommend that you make your payment a minimum of 4 or 5 working days before the due date.

Subcategories

Page 1 of 2

- 1

- 2